Searching for the best Kansas City interest rates? If you’re house hunting, you’re likely well aware of rising interest rates. In 2020, buyers were scoring big time with 30-year rates as low as 2.8%. Fast forward to July of 2022, the average 30-year rate is about 5.7%. If increased rates have you feeling discouraged, this blog post is for you! We’ll be exploring historical interest rates and why you shouldn’t worry too much in the grand scheme of homeownership.

If you’re stumbling across our blog for the first time, welcome to The Small Real Estate Team! Our small, yet mighty, team of four has over 50 years of collective experience. It is our privilege to help our community with all of their real estate needs, including helping our clients navigate the lending process! If you want a trusted realtor on your side, please don’t hesitate to reach out to our team by filling out this form on our website or giving us a call at (816) 407-5224. We hope you enjoy learning more about Kansas City interest rates.

Comparing Rates Over The Last 30 Years

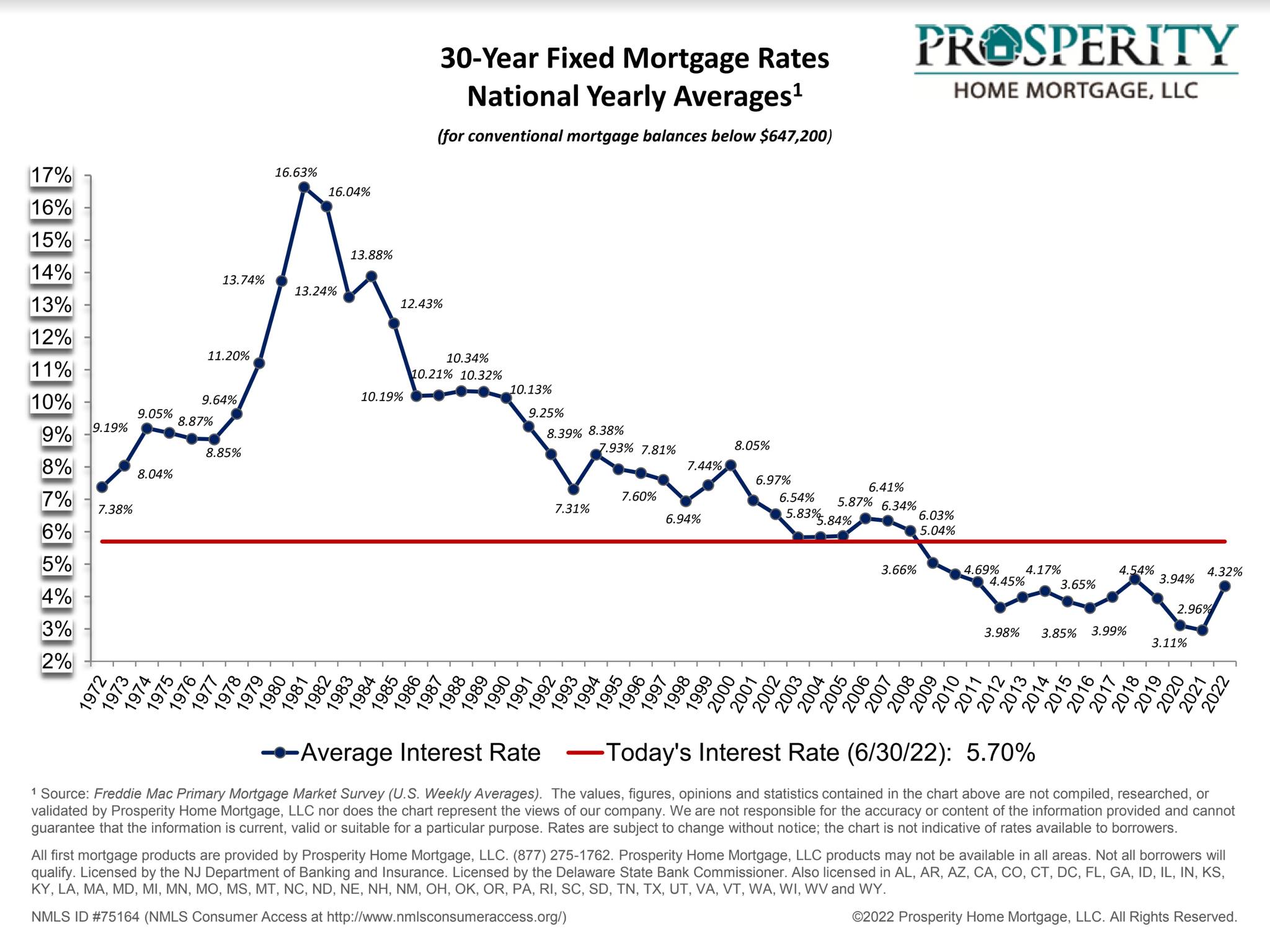

Take a look at the graph below, provided by our friends at Prosperity Home Mortgage. This data highlights historical interest rates over the last 30 years. As you can see, although rates have risen slightly, now is still a great opportunity to invest in a home!

Interest Rates Were Once 18.45%

Jumping from a 3% to 5% might come with a little sticker shock, but you’re still able to lock in an incredibly low-interest rate! In October of 1981, the highest recorded 30-year interest rate was a whopping 18.45%! That same year, the annual average was 16.63%. With this in mind, homeowners need to remember that a 5% interest rate is still an amazing investment opportunity. You can learn more about historical interest rates in the United States here.

Understanding Why Rates Plummeted

We all remember 2020 as a wild year. In response to the Covid-19 pandemic, the Federal Reserve slashed interest rates to help stimulate the economy. This encouraged borrowing, which created a surge of demand in the housing market. Now that rates have returned to back to normal, buyers have a false sense of what a good interest rate is. Of course, the lower the rate you can get the better. That being said, buyers shouldn’t necessarily put off buying a home while they hope for rates to decline. It doesn’t look like they will be plummeting again any time soon!

To Combat Inflation, Rates Are Rising

You may be wondering why rates have gone up? In short, The Federal Reserve has raised interest rates in an attempt to curb record-high inflation. As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.

The pandemic and the war in Ukraine have caused nationwide supply chain disruptions. There’s no knowing if or when interest rates will decline. Contrary, rates will likely continue to climb. Therefore, buyers should not be wary of a small spike in interest rates. After all, a 5% interest rate is still very low in comparison to rates over the last 30 years!

Why You Should Buy In Kansas City Now!

If you’ve lived in the Kansas City area for a while, you’re likely stunned by the growth of the City and surrounding suburbs. With the location becoming more and more in high demand, housing prices are soaring. If you plan to live in the area long-term, it’s smart to invest in a home before prices increase further.

Thinking the price of new construction will go down? Think again. Wages and supplies are at an all-time high. However, there are perks to higher interest rates. Since demand is lower, the market is becoming less competitive. This means buyers will be able to shop around more and their home buying journey could be significantly less stressful.

Score The Lowest Interest Rate Possible

If you want to save as much on interest as possible, you have a few options. First, you can opt for a 15-year mortgage instead of a 30-year. Sure, your monthly payment will be more but imagine having your home paid off in just 15 years! Not only will this be a sigh of relief, but you’ll also save a fortune in interest.

In addition, to secure a lower interest rate you can put more money down. A larger downpayment means you pose less of a risk to the lender, so they can offer a lower interest rate in return. Additionally, it’s important to show proof of steady income as well as a low debt to income ratio. Lenders look for consistent and reliable sources of income so that they feel confident in your ability to make timely payments. Finally, maintaining a good credit score is essential. If you have a history of late or missed payments, your interest rate will be higher.

House-Hunting In Kansas City?

Buying a home can be a bit overwhelming when you start crunching the numbers. That being said, becoming a homeowner is one of the most rewarding investments you’ll likely ever make! If you’re house-hunting in the Kansas City or surrounding areas, The Small Real Estate Team would love to help you navigate this complex process. Not only can we help you buy and sell your home, but we can also connect you with trusted mortgage lenders.

For more information about working with The Small Real Estate Team, fill out this form on our website or give us a call at (816) 407-5224. If you would like to check out our current listings, click here. We’d love for you to follow the fun on Facebook & Instagram! Don’t forget to ask these questions before hiring a realtor! We hope you enjoyed hearing our feedback regarding Kansas City interest rates.

Read Reviews From Our Happy Clients

When choosing a realtor, it can be a little overwhelming if you don’t know where to start! Reviews and testimonials from previous buyers are great tools for evaluating your options. Our client, Ginger, was kind enough to write us a Google review. Click here to read more from our happy clients!

Ginger says, “The Small Real Estate Team was nothing short of fantastic to work with! Charles and his team took care of us and every detail that needed to get done was communicated and carried out without issue. He listened to us and what we wanted! He helped my daughter and son-in-law, buy and sell a house also. We found our perfect home and from the beginning to the end the sale process went smooth! We will recommend Charles and his team to anyone we know buying or selling!”

Don’t Miss This Testimonial!

Still need some more convincing? Check out the video below to watch a testimonial from one of our THREE-time clients! Throughout your life, your residential needs will inevitably change. From purchasing a bigger home as your family grows to downsizing in your retirement years, you can count on The Small Team to assist you through it all!

Jeff Says: “What was important to us when picking a real estate agent was choosing someone who had our best interest in mind, and weren’t looking to push a deal at any cost, but someone who was truly looking out for our needs and what would be in the best interest for our situation.”

Racheal Says: “Overall, we just loved working with The Small Team and if you’re looking for a real estate agent, we definitely recommend working with them”.